46 States Don't Provide Adequate Insurance Coverage For Addiction Treatment

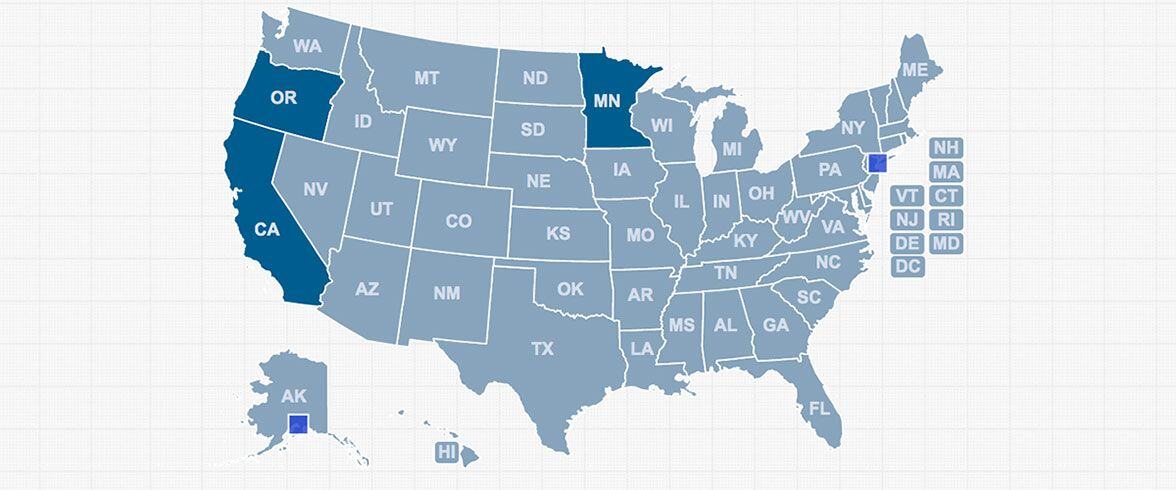

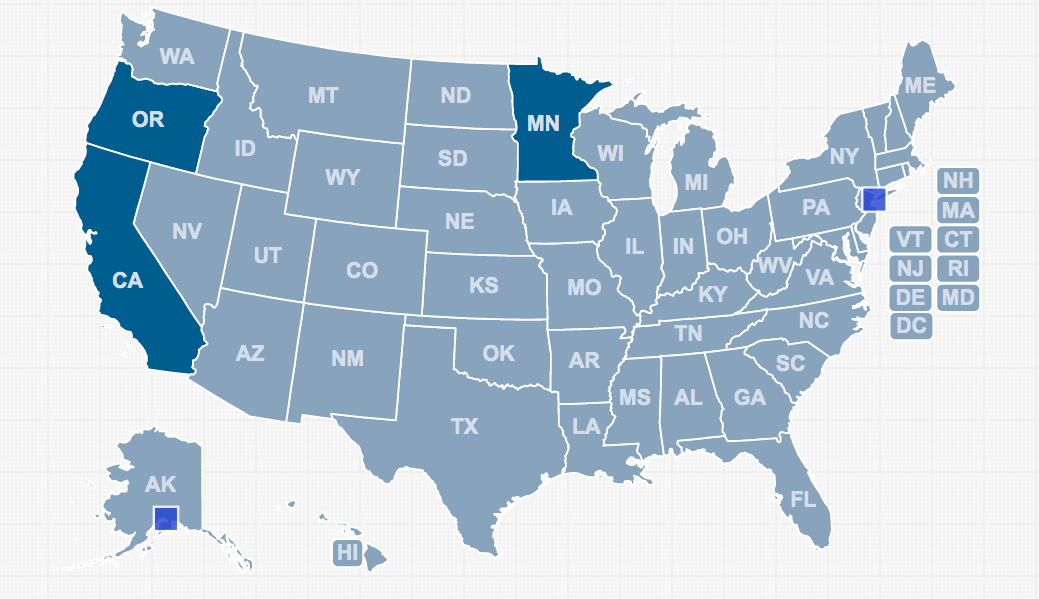

According to a recently released report from the Center on Addiction, only RI provided comprehensive addiction treatment coverage in the two 2017 ACA plans reviewed. CA, MN and OR offered at least one plan with comprehensive coverage. The remaining 46 states did not offer any comprehensive addiction treatment coverage plans.

Making matters worse, 20% of states offered a plan that was actually in violation of a federal law that requires insurers to cover addiction treatment the way they do for chronic physical conditions such as cancer, diabetes, hypertension, etc. (the Federal Parity Act of 2008).

Making matters worse, 20% of states offered a plan that was actually in violation of a federal law that requires insurers to cover addiction treatment the way they do for chronic physical conditions such as cancer, diabetes, hypertension, etc. (the Federal Parity Act of 2008).

And then, things really deteriorate in how the 3/26/19 online report notes how coverage has degraded for methadone, the universally recognized leading treatment for opioid addiction.

Not surprisingly, the report mentions how most people can’t afford addiction treatment unless it’s covered by their insurance plan(s).

Even when patients / clients have coverage, you’re no doubt seeing how reimbursements are becoming less and less. As a result, you’re also seeing how personal responsibility amounts are growing almost to the point where the person could owe as much – or more – than their insurance reimburses.

This places a tremendous financial burden on treatment centers since it’s critical that personal responsibility amounts be obtained. The secondary, but no less impactful burden, is the work typically involved in pursuing those patients / clients to pay.

To help overcome both burdens, technology should be in place that supports an ability for you to advise the person in advance (ideally during scheduling) an approximation as to what he or she will owe after insurance(s) reimburses.

You’d be able to have a “what you’ll owe” conversation while you’re in more of a position of strength vs. later when you’re much more vulnerable. You can prepare the person for at least a partial payment on arrival, with a solid payment plan scheduled which the system should also accommodate. Regardless, the person can’t be surprised when their statement arrives. In a best case scenario, you might even get some full payments.

An in-advance patient responsibility estimator is a powerful tool for keeping patient / client balances in excellent shape at a time when reimbursements aren’t what they used to be.

Side note: another piece of “technology insurance” for being paid by patients / clients involves making certain they’re engaged and having an enhanced experience (in other words, “happy”). Ideal solutions for this include iPad, iPhone and Android-friendly portals that enable the person complete a majority of intake in advance at their convenience and for paying online, kiosks that support self-registrations, telemedicine and virtual consults which also increase revenue, and interactive appointment reminder and balance due texts.

Side note: another piece of “technology insurance” for being paid by patients / clients involves making certain they’re engaged and having an enhanced experience (in other words, “happy”). Ideal solutions for this include iPad, iPhone and Android-friendly portals that enable the person complete a majority of intake in advance at their convenience and for paying online, kiosks that support self-registrations, telemedicine and virtual consults which also increase revenue, and interactive appointment reminder and balance due texts.

By the way, these all work wonders for ensuring your providers and the facility itself have great experiences as well.

Of course everyone has to pay, but it stands to reason those who are engaged and happy, and who have expanded capabilities to pay will be more inclined to do so.

Our MedicsCloud Suite for Behavioral Health and Addiction Disorders supports tools for proactively determining patient / client responsibility amounts after insurance (can be accessed during scheduling), and for pre-appointment batch eligibility of benefits verifications, both of which provide powerful resources helping to ensure your facility is paid.

The system maintains a nearly 100% success rate on first attempt HCFA and UB clearinghouse claims and has the engagement and experience-enhancing tools needed today.

The Suite’s 2015 certified EHR is ideal for every level of care. It contains a no-cost comprehensive bed manager for inpatient facilities, and it has a built-in MACRA dashboard.

Contact ADS at 800-899-4237, Ext. 2264 or email info@adsc.com for more information or to schedule a personalized overview of the MedicsCloud Suite, or to learn more about MedicsRCM if comprehensive revenue cycle management is preferred. MedicsRCM typically increases our clients’ revenue by 10% - 20%.

About Marc Klar

Marc has decades of experience in medical software sales, marketing, and management.

As Vice President of Marketing, Marc oversees the entire marketing effort for ADS (the MedicsCloud Suite) and ADS RCM (MedicsRCM).

Among other things, Marc enjoys writing (he’s had articles published), reading, cooking, and performing comedy which sometimes isn’t funny for him or his audience. An accomplished drummer, Marc has studied with some of the top jazz drummers in NYC, and he plays with two jazz big bands. Marc was in the 199th Army Band because the first 198 didn’t want him, and he has taught drumming at several music schools.

Next: read our ADS and ADS RCM blogs, ebooks and whitepapers. They’ll stimulate your brain as well.